Senior Citizen Property Tax Exemption Cook County Illinois . To receive the senior citizen homestead. to apply for a prorated senior exemption you must submit the following: a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property. the senior citizen homestead exemption reduces the eav of your home by $8,000. Property tax exemptions are provided for owners with the following situations: the senior citizens assessment freeze homestead exemption. most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar.

from www.formsbank.com

Property tax exemptions are provided for owners with the following situations: senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. to apply for a prorated senior exemption you must submit the following: the senior citizen homestead exemption reduces the eav of your home by $8,000. the senior citizens assessment freeze homestead exemption. To receive the senior citizen homestead. most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property.

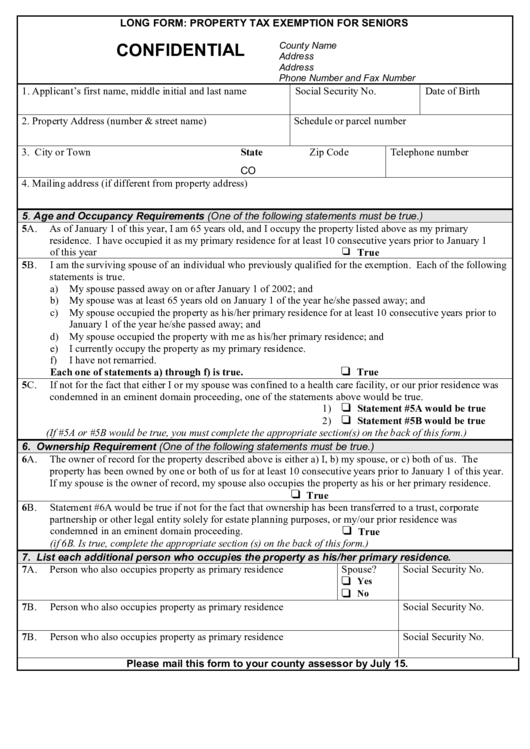

Long Form Property Tax Exemption For Seniors printable pdf download

Senior Citizen Property Tax Exemption Cook County Illinois the senior citizens assessment freeze homestead exemption. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. the senior citizens assessment freeze homestead exemption. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property. Property tax exemptions are provided for owners with the following situations: to apply for a prorated senior exemption you must submit the following: To receive the senior citizen homestead. the senior citizen homestead exemption reduces the eav of your home by $8,000. most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy.

From barringtonhills-il.gov

Cook County Tax Exemptions For Seniors Village of Barrington Hills Senior Citizen Property Tax Exemption Cook County Illinois the senior citizens assessment freeze homestead exemption. to apply for a prorated senior exemption you must submit the following: To receive the senior citizen homestead. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property. most senior homeowners are eligible for this exemption if they are 65. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.youtube.com

Property Tax Exemptions for Seniors and Veterans YouTube Senior Citizen Property Tax Exemption Cook County Illinois the senior citizens assessment freeze homestead exemption. the senior citizen homestead exemption reduces the eav of your home by $8,000. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. most senior homeowners are eligible for. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.44thward.org

Deadline Extended for Property Tax Exemptions! Alderman Lawson 44th Ward Chicago Senior Citizen Property Tax Exemption Cook County Illinois senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. the senior citizen homestead exemption reduces the eav of your home by $8,000. most senior homeowners are eligible for this exemption if they are 65 years of. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.pdffiller.com

Fillable Online Senior citizens exemption Department of Taxation and FinanceThe Senior Citizen Senior Citizen Property Tax Exemption Cook County Illinois Property tax exemptions are provided for owners with the following situations: senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. To receive the senior citizen homestead. the senior citizens assessment freeze homestead exemption. to apply for. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.formsbank.com

Fillable Short Form Property Tax Exemption For Seniors 2017 printable pdf download Senior Citizen Property Tax Exemption Cook County Illinois to apply for a prorated senior exemption you must submit the following: senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. To receive the senior citizen homestead. the senior citizens assessment freeze homestead exemption. most. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.exemptform.com

Cook County Senior Citizen Exemption Form Senior Citizen Property Tax Exemption Cook County Illinois the senior citizens assessment freeze homestead exemption. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property. most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. senior homeowners are eligible. Senior Citizen Property Tax Exemption Cook County Illinois.

From patch.com

Cook County Assessor Deadline for Senior Citizen Exemption is Today Wilmette, IL Patch Senior Citizen Property Tax Exemption Cook County Illinois to apply for a prorated senior exemption you must submit the following: Property tax exemptions are provided for owners with the following situations: a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property. senior homeowners are eligible for this exemption if they are over 65 years of age. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.44thward.org

Cook County Senior Citizen Property Tax Deferral Alderman Lawson 44th Ward Chicago Senior Citizen Property Tax Exemption Cook County Illinois to apply for a prorated senior exemption you must submit the following: Property tax exemptions are provided for owners with the following situations: a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property. To receive the senior citizen homestead. the senior citizen homestead exemption reduces the eav of. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.exemptform.com

Senior Citizen Assessment Freeze Exemption Cook County Form Senior Citizen Property Tax Exemption Cook County Illinois Property tax exemptions are provided for owners with the following situations: most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. to apply for a prorated senior exemption you must submit the following: the senior citizens assessment freeze homestead exemption. To. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.formsbank.com

Form Ptax340 Application And Affidavit For Senior Citizens Assessment Freeze Homestead Senior Citizen Property Tax Exemption Cook County Illinois to apply for a prorated senior exemption you must submit the following: a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible property. the senior citizen homestead exemption reduces the eav of your home by $8,000. most senior homeowners are eligible for this exemption if they are 65. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.44thward.org

Senior Freeze Exemption Cook County Alderman Lawson 44th Ward Chicago Senior Citizen Property Tax Exemption Cook County Illinois To receive the senior citizen homestead. to apply for a prorated senior exemption you must submit the following: the senior citizens assessment freeze homestead exemption. most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. a senior freeze exemption provides. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.cookcountyassessor.com

Property Tax Saving Exemptions Cook County Assessor's Office Cook County Assessor's Office Senior Citizen Property Tax Exemption Cook County Illinois senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. Property tax exemptions are provided for owners with the following situations: a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.youtube.com

COOK COUNTY TRICKS SENIORS INTO PAYING HIGHER PROPERTY TAXES there are TWO EXEMPTIONS for Senior Citizen Property Tax Exemption Cook County Illinois most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. the senior citizens assessment freeze homestead exemption. the senior citizen homestead exemption reduces the eav of your home by $8,000. Property tax exemptions are provided for owners with the following situations:. Senior Citizen Property Tax Exemption Cook County Illinois.

From pastureandpearl.com

Cook County Senior Exemption August 2024 Senior Citizen Property Tax Exemption Cook County Illinois senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 calendar. To receive the senior citizen homestead. most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior). Senior Citizen Property Tax Exemption Cook County Illinois.

From www.entitledrefunds.com

Homestead Exemption Info Property Tax Cook County, IL Senior Citizen Property Tax Exemption Cook County Illinois the senior citizen homestead exemption reduces the eav of your home by $8,000. most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.youtube.com

Property Tax Saving Exemptions Cook County Assessor's Office YouTube Senior Citizen Property Tax Exemption Cook County Illinois the senior citizen homestead exemption reduces the eav of your home by $8,000. Property tax exemptions are provided for owners with the following situations: most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy. To receive the senior citizen homestead. a. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.formsbank.com

Instructions For Form Rp467I Application For The Partial Real Property Tax Exemption For Senior Citizen Property Tax Exemption Cook County Illinois To receive the senior citizen homestead. the senior citizen homestead exemption reduces the eav of your home by $8,000. Property tax exemptions are provided for owners with the following situations: senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. Senior Citizen Property Tax Exemption Cook County Illinois.

From www.pdffiller.com

Fillable Online 20242025 Senior Citizens' Property Tax Exemption Application Fax Email Senior Citizen Property Tax Exemption Cook County Illinois Property tax exemptions are provided for owners with the following situations: the senior citizen homestead exemption reduces the eav of your home by $8,000. to apply for a prorated senior exemption you must submit the following: To receive the senior citizen homestead. the senior citizens assessment freeze homestead exemption. senior homeowners are eligible for this exemption. Senior Citizen Property Tax Exemption Cook County Illinois.